Agency Service of International Procedure

for Overseas Residents/Immigrants to Japan

by Lifemates (Labor & Social Security Attorney Office in Japan)

Useful Informatmion of Administrative & specialized procedures in Japan

9. Japanese Pension System

~The Mutual Aid Pension for Public Servants and School Staff

Even overseas residents who previously enrolled in Japan's pension system can receive retirement pension benefits if they meet certain conditions, regardless of how short their enrollment period was. Moreover, they can receive both their current country's pension and Japan's pension. When I began supporting overseas residents with Japanese pension applications about 15 years ago, far fewer overseas residents qualified for pension benefits than today. However, subsequent pension system reforms(※1) and improvements addressing the difficulties overseas residents faced with the application process(※2) have expanded eligibility. Combined with the effectiveness of promotional activities targeting overseas residents, more overseas residents are now able to apply for Japanese pensions.

However compared to residents in Japan, the application process remains complex and difficult to understand, and there are still voices saying they don't know how to proceed with the procedures.

This time, we will introduce the confusion surrounding Japanese pension procedures from the perspective of overseas residents, specifically focusing on the types of pensions managed by different pension organizations.

1. Pension Administrators and Types

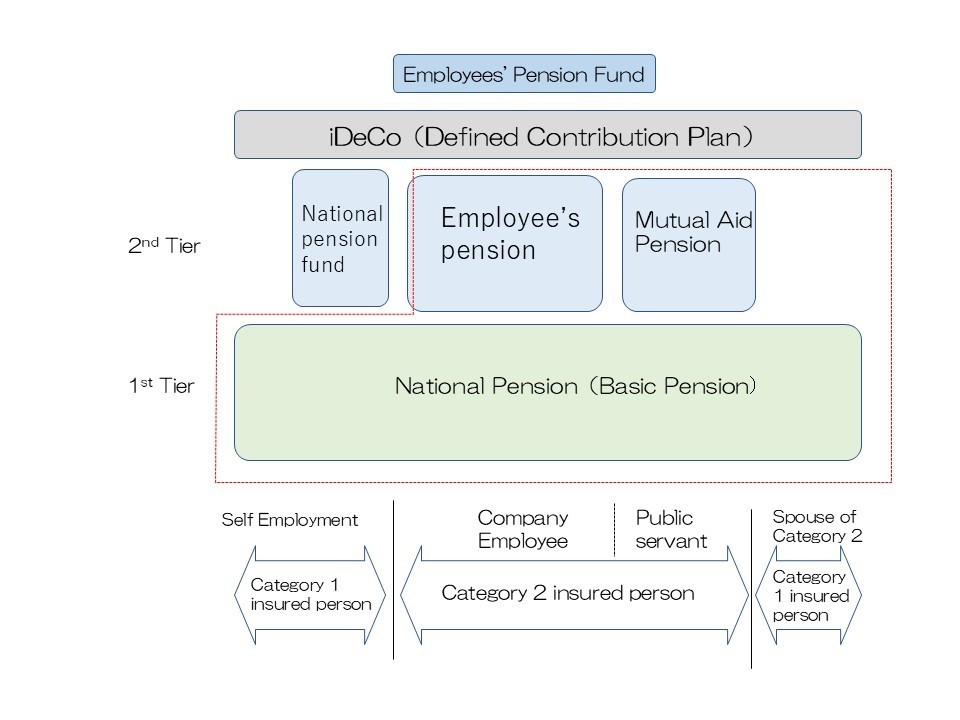

The widely known public pensions in Japan are the Employees' Pension Insurance and the National Pension. Both are administered and managed by the Japan Pension Service. Employees' Pension Insurance covers salaried workers such as company employees, while the National Pension covers others including the self-employed, housewives, students, and the unemployed. Pension contributors are called “Insured Persons,” categorized into three types: Type 1, Type 2, and Type 3. The following diagram illustrates the pension types and their corresponding insured persons.

Types of Public Pensions in Japan

The red-line box indicates the public pension portion, but other related pensions are also listed for reference.

All insured persons are enrolled in the National Pension, referred to as the “first tier” (enrollment is mandatory). Among these, Category 2 insured persons who are company employees are enrolled in the National Pension plus the Employees' Pension Insurance, collectively known as the “first tier + second tier.” However, among these Category 2 insured persons, civil servants, school staff, and others are enrolled in the Mutual Aid Pension instead of the Employees' Pension Insurance.

This Mutual Aid Pension, which civil servants (national and local) and school staff (teachers, clerical workers) join, is operated and managed by various mutual aid associations. While I wrote “various mutual aid associations,” there are multiple associations depending on the affiliated institution, leading to inconveniences such as not knowing the contact information even when inquiring. To resolve this, the “Employee Pension Unification Act” was enacted on October 1, 2015. This unified the pension systems for Category 2 employees, previously split between the Employees' Pension and the Mutual Aid Pension, under the Employees' Pension. ※3

Consequently, application procedures can now be handled at any Japan Pension Service office nationwide.

2, About Mutual Aid Associations

While the Japan Pension Service is a massive organization covering all private sector employees※4, mutual aid associations for public servants and school staff exist separately for each affiliated institution. The main mutual aid associations are as follows:

● National Public Servant Mutual Aid Association (Federation)

● Local Public Servant Mutual Aid Association (Federation)

● Police Employees Mutual Aid Association

● Public School Mutual Aid Association

● Japan Private School Promotion and Mutual Aid Corporation, etc.

The role of each mutual aid association is to provide welfare benefits for employees (members) and their families. They offer services equivalent to those provided by the Japan Pension Service (Health Insurance Associations) for private companies, such as health insurance (excluding pensions) and family-oriented lodging facilities. While the list above shows mutual aid associations consolidated into federations to streamline pension application procedures, the Civil Servants Mutual Aid Association further divides its branches by ministry, agency, and prefecture.

3 Challenges in Pension Procedures

With the 2015 pension unification, individuals who were previously enrolled in mutual aid pension plans can now handle their procedures as Employees' Pension Insurance through the Japan Pension Service. This represents significant progress, as individuals who have changed jobs and enrolled in both the Employees' Pension Insurance and the Mutual Aid Pension System no longer need to handle separate procedures; they can now complete everything at any pension office nationwide. However, progress toward full unification remains insufficient, and procedural hurdles appear particularly high for overseas residents.

Based on practical experience handling pension applications for many individuals, Here are some issues I've been noticing.

●For the National Public Servant Mutual Aid Association and the Local Public Servant Mutual Aid Association, each ministry, agency, and prefecture has a branch office, with the final place of employment serving as the responsible contact point. Given that these occupations often involve frequent transfers, it can be difficult to identify the correct contact point. Furthermore, many offices are located in only one location per prefecture, causing inconvenience.

●Although it has been ten years since the mutual aid pension was unified with the Employees' Pension Insurance, procedures for members enrolled solely in the mutual aid pension and for those who reached pension eligibility age before the 2015 unification remain handled by the mutual aid associations. In some cases, procedures may need to be conducted at two locations: the mutual aid association and the Japan Pension Service.

●Information sharing regarding procedures for overseas residents among the staff responsible at each mutual aid association is delayed, making it difficult to obtain accurate information, such as the required documents to submit.

How about this? In addition to the above, there are other challenges such as limited contact points for mutual aid associations, making it difficult to connect when calling from overseas, and insufficient digitization of forms (resulting in time-consuming document submission via international mail). If you are unsure about the procedures or are having trouble proceeding, please consult us.

※1: Shortening the required pension enrollment period

※2: Various certificates differing by country and internal staff information sharing regarding support for overseas residents

※3: For details, refer to the Japan Pension Service below https://www.nenkin.go.jp/service/jukyu/seido/kyotsu/joho/ichigenka/20150917.html

※4: Primarily applies to regular employees, but will be expanded to some non-regular employees starting in 2024

Disclaimer

The information in this column is based on the scope of our company's research and acquisition to date. We cannot guarantee the content, as it may be incorrect or have been revised or changed during the customer's procedures. When you are going through the procedures, please check the latest information with the relevant organizations or a specialist in this area yourself. Our company will not be held responsible for any disadvantages incurred by the customer due to this information.

Thank you for visiting our Website. If you have any inquiry or would like our consulting service, please contact us by telephone or email.

※From outside of Japan : 81-3-6411-8984

※We can receive phone call between

9:00~18:00

We are open to email 24 hours.

Menu

- 事務所紹介

Contact Information

Please Contact Us

Please Contact Us by Telephone or Email.

Open / Close

Open Time

9:00~18:00

Close

Sunday, National Holiday

Office Location

〒157-0072

1-17 Soshigaya, Setagaya-ku, Tokyo