Agency Service of International Procedure

for Overseas Residents/Immigrants to Japan

by Lifemates (Labor & Social Security Attorney Office in Japan)

Useful Informatmion of Administrative & specialized procedures in Japan

5. Recent news about US Social Security that Japanese pension recipients should know about

~Impact and procedures related to the review and abolition of the Social Security WEP (reduction measure) system ~

Among U.S. residents (and those returning to Japan), Japanese pension recipients are likely to be interested in the recent decision by the Social Security Administration (SSA) to abolish the WEP system. During their working years, they contributed to pension systems (Social Security) in both Japan and the U.S. and paid pension premiums and SS taxes in accordance with each country's laws. However, upon retiring and beginning to receive benefits, their SS benefits were partially reduced due to their pension enrollment status in Japan. This rule was difficult to understand. In that sense, for recipients who were subject to the reduction, this announcement is welcome news, as it means their SS benefits will be increased to the original amount.

In this article, we will introduce the beneficiaries of this system reform, the benefits they will receive, and the procedures required. If there are any readers who are unaware of this news, have heard about it but do not fully understand it, or know about it but are unclear on the necessary procedures, we hope this information will be helpful.

1. What is WEP?

The Windfall Elimination Provision (WEP) is a provision that reduces the amount of Social Security benefits received in retirement if an individual worked for an employer that did not withhold Social Security taxes from their wages while employed (such as government agencies or companies outside the United States). For individuals who previously resided in Japan, this applies to those who were employed as salaried workers or civil servants and were enrolled in the Employees' Pension Insurance or the Mutual Aid Pension System. Not all pension enrollees are subject to reduction, but if deemed eligible based on enrollment status, the U.S. pension will be reduced according to a specific calculation method.

2. SSA announcements and their effects

Recently, there have been two announcements from the SSA regarding Japanese pension recipients.

①Revision of the calculation method for US pension benefits under WEP

As explained in 1 above, the reduction in US pensions applies to people who were previously enrolled in the Japanese Employees' Pension Insurance (or Mutual Aid Pension) system, but in fact, National Pension recipients (who were not enrolled in the Employees' Pension Insurance) were also mistakenly included in the scope of application. As a result, the National Pension portion, which should not have been reduced, was also reduced. The SSA acknowledged this error and announced that it would retroactively review the amounts that were incorrectly reduced and refund them to recipients in the future.

(Reference: U.S. Embassy in Japan website)

https://jp.usembassy.gov/ja/services-ja/social-security-ja/wep-ja/

②Abolition of the WEP system

This system itself has been abolished. Although it was announced by then-President Biden in January 2025, it will be applied retroactively to January 2024 (for pensions received in February 2024) when the bill, the Social Security Fairness Act of 2023, was enacted.

(Reference: Japan Pension Service website)

https://www.nenkin.go.jp/oshirase/taisetu/2025/202504/0417.html

3. Required procedures

●Regarding above ①

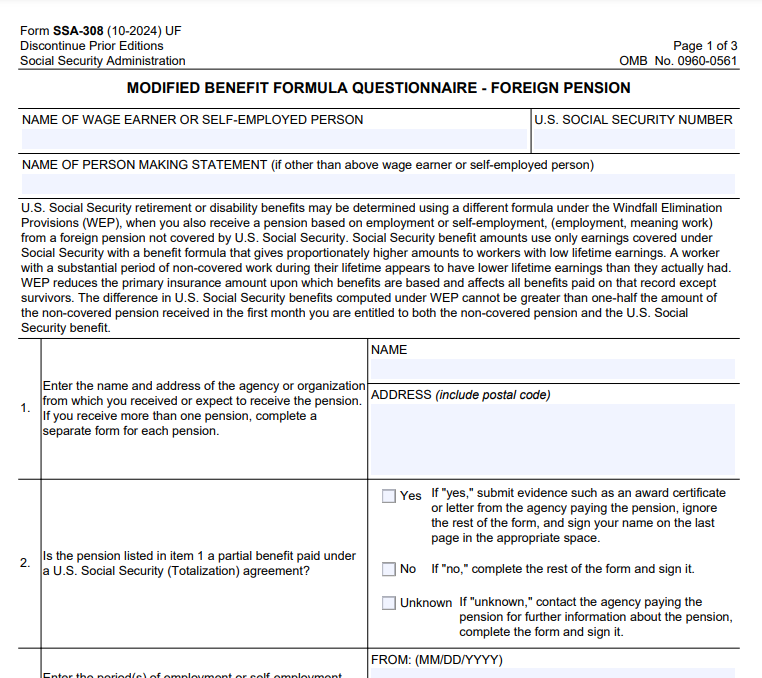

The SSA sends letters in English to recipients of U.S. pensions who the SSA has determined to be receiving incorrect amounts (including those residing outside the U.S.). The letter includes an explanation of the announcement and a response form, “Form SSA-308,” which requires you to fill in your Japanese pension enrollment status (type of pension, insurer (operator), enrollment period, etc.). After you confirm your Japanese pension enrollment status, fill out and return the form. If you are unsure of your Japanese pension enrollment status, you had better to contact the "Japanese Pension Service" or the pension department of the Mutual Aid Association in Japan, which is the insurer, by phone. They will not provide answers over the phone, but you can visit them in person when you come to Japan or ask a representative in Japan (relative, acquaintance, or expert) to investigate on your behalf. For details, please contact each insurer. ※1

If you are receiving a reduced Social Security but have not received the English-language letter, please contact the SSA. Within the U.S., contact the nearest SSA office; in Japan, contact the Pension Division of the U.S. Embassy in Tokyo.

(Reference: U.S. Embassy website / English-language letter content and Japanese translation)

https://jp.usembassy.gov/wp-content/uploads/sites/7/2024/10/fbu-wep-information-request.pdf

Form SSA-308 included in the letter

●Regarding above ②

No further action is required. Recipients who are believed to be eligible for the reduction under WEP will receive the difference between the original US pension amount and the reduced amount retroactively from the date of abolition.

【Important】

4. Other systems you should know about: “Supplementary Pension (Kakyu Nenkin)” applicable to Employees’Pension Insurance members

●Additional pension added to the old-age pensio

For Japanese Employees' Pension Insurance members, if the following requirements are met, a Supplementary pension (Family Allowance) will be added to the original old-age Employees' Pension Insurance.

A) Have been enrolled in Employees' Pension Insurance (Mutual Aid Pension Insurance) for 20 years (240 months) or more

B) Have a spouse or child (under 18 years of age) with an annual income of 8.5 million yen or less at the age of 65

●The requirements can also be met by totaling the SS subscription period

There is a special case that U.S. residents (SS contributors) should know. Regarding the above A) requirement, even if the period of enrollment in the Employees' Pension Insurance is less than 20 years, the period of enrollment in the U.S. Social Security system (SS Tax payment period) may be combined (totaled). For example, if you worked as a salaried employee in Japan for 12 years and were enrolled in the Employees' Pension Insurance, then moved to the U.S. and worked for 20 years while paying SS taxes, the combined enrollment period in Japan and the U.S. would be 32 years, meeting the requirements of A) above. However, in this case, the supplementary pension paid would be a prorated amount of the original amount (in this example, “12 years/20 years” (60%) of the original amount).

●If you file a petition for aggregation with the SS enrollment period, the SSA will know about your Japanese pension enrollment...

Actually, regarding requirement A), when US residents with less than 20 years of Japanese pension enrollment applied for additional pension benefits under special circumstances, the Japan Pension Service directly inquired with the SSA about the applicant's SS enrollment period. As a result, the SSA became aware that the applicant was enrolled in the Japanese pension system and registered them as eligible for WEP. (Note: Originally, the SSA's confirmation of whether an individual was a recipient of Japanese Employees' Pension Insurance benefits was based on information sharing during such optional separate procedures and self-declaration by the applicant, and there was no ongoing data sharing between Japan and the United States.)

As a result, even if someone with less than 20 years of enrollment in the Japanese Employees' Pension Insurance applied for the supplementary pension under the special provision (A), their U.S. pension would be reduced, so some people chose not to apply for the supplementary pension under this special provision. However, with the recent decision to abolish the WEP, there will no longer be a reduction in the U.S. pension. Therefore, even now, if you apply for the supplementary pension through the Japan Pension Agency, you can receive the additional amount.

How about it? It may be a little technical and difficult to understand. Item 4 above is particularly technical. If you do not understand it well, please contact us by email or through our website (there is an inquiry menu).

Disclaimer

The information in this column is based on the scope of our company's research and acquisition to date. We cannot guarantee the content, as it may be incorrect or have been revised or changed during the customer's procedures. When you are going through the procedures, please check the latest information with the relevant organizations or a specialist in this area yourself. Our company will not be held responsible for any disadvantages incurred by the customer due to this information.

Thank you for visiting our Website. If you have any inquiry or would like our consulting service, please contact us by telephone or email.

※From outside of Japan : 81-3-6411-8984

※We can receive phone call between

9:00~18:00

We are open to email 24 hours.

Menu

- 事務所紹介

Contact Information

Please Contact Us

Please Contact Us by Telephone or Email.

Open / Close

Open Time

9:00~18:00

Close

Sunday, National Holiday

Office Location

〒157-0072

1-17 Soshigaya, Setagaya-ku, Tokyo